- Upcoming changes: New Labour government has proposed that from April 2027, most unused pension funds and death benefits will be included within the value of a person’s estate for IHT purposes. This removes an exemption that could have saved IHT of up to 40% of the value of the pension fund.1

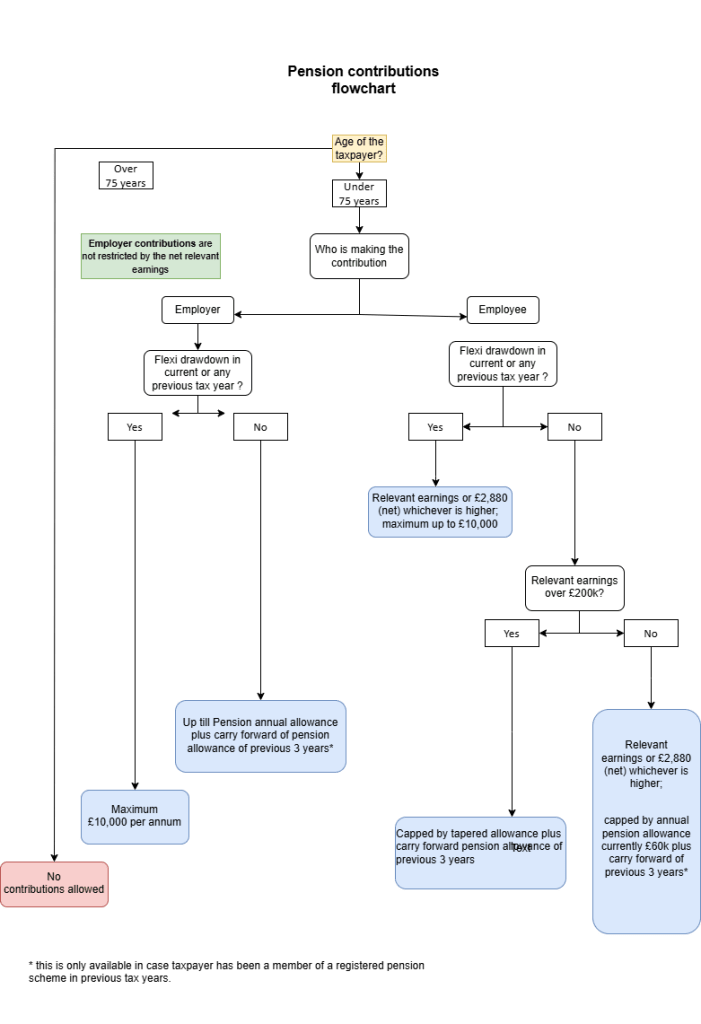

- The maximum amount of contributions (subject to Pension annual allowance below) on which a member can have tax relief in any tax year is potentially greater of:

– the ‘basic amount’ – currently £3,600 (gross), or

– the amount of the individual’srelevant UK earningsthat are chargeable to income tax for the tax year.

Example : Individual’s annual salary is £12,000. Maximum net can put in his pension is £12000 x 0.80 = £9,600 because with HMRC relief of 20% of £2,400 (£12,000-£9,600) gross becomes £12,000.

Pension income– either from a defined benefit, defined contribution or the State Pension – isn’t classed asrelevant UK earnings.2

For a detailed list of what is classed as relevant earnings see PTM044100.

Employer contributions are not restricted by the net relevant earnings. 3 But again restricted by Pension annual allowance below.

3. Pension annual allowance: Maximum amount a tax payer can deposit in pension in a year is £60k4. This amount includes Employee contribution, Employer contribution and HMRC Relief5.

Carry forward: This allowance can be increased by any unused annual allowance of the previous three tax years6, this is only available in case taxpayer has been a member of a registered pension scheme in previous tax years.

Taper: If annual income of the tax payer goes over £200k, they should calculate Tapered Annual allowance. Use our excel tool to calculate it.

Flexi access: If taxpayer withdraws funds under ‘flexible drawdown arrangements’ from his pension annual allowance is restricted to `money purchase annual allowance` (MPAA) currently £10,000. 7 Once tax payer accesses pension flexibly MPAA calculation will need to be done for that and every subsequent tax year.10 For example calculation see PTM056540 or Tolley Tax computations 19.3 D. Also note carry forward allowance are not added to MPAA.11

4. Age: Contributions are not permitted by taxpayers over the age of 75. 8

5. Time limit: Pension contributions need to be actually paid within the tax year. Tax relief can only be claimed in the tax year in which payment is made. There is no provision to carry back or forward to other tax years.9

6.Tax free lumpsums: Life time allowance was abolished from 6 April 2024. But Tax free lump sum allowance is still £268,275 [25% of £1,073,100 (lifetime allowance)]. But this may be higher if you hold a protected allowance.

7. Tax planning:

a) An individual with only investment income can still save £2,880 (net) and get £20% back from HMRC in his pension pot + increase his basic rate band.

b) Additional savings can be made by individuals with income at margins of income tax rate bands e.g. an individual earning just above £50k or £100k.

Source:

- Inheritance Tax on pensions: liability, reporting and payment – GOV.UK

- PTM044100

- Tolley Exam 29.7

- Pension schemes rates – GOV.UK

- Tolley Annual Income tax 56.24

- Tolley Exam 29.8

- Tolley Exam 30.3

- Tolley Exam 29.4

- Alan Melville Pg 206

- Tolley Annual 56.23

- HS345 Pension savings — tax charges which includes a calculator.