1. Introduction

Today “the give away Chancellor” Rishi Sunak has announced a string of measures to kick-start the economy.

2. Job Retention Bonus

A one-off payment of £1,000 to UK employers for every furloughed employee who remains continuously employed through to the end of January 2021. Employees must earn above the Lower Earnings Limit (£520 per month) on average between the end of the Coronavirus Job Retention Scheme and the end of January 2021. Payments will be made from February 2021. Further detail about the scheme will be announced by the end of July.

3. Hospitality sector

This sector has been among the hardest hit by the pandemic and necessary restrictions.

3.1 Eat Out to Help Out – This will entitle every diner to a 50% discount of up to £10 per head on their meal, at any participating restaurant, café, pub or other eligible food service establishment. The discount can be used unlimited times and will be valid Monday to Wednesday on any eat-in meal (including on non-alcoholic drinks) for the entire month of August 2020 across the UK. Participating establishments will be fully reimbursed for the 50% discount. Further details of how to sign up for this are awaited.

3.2 Temporary VAT cut for food and non-alcoholic drinks – From 15 July 2020 to 12 January 2021, to support businesses and jobs in the hospitality sector, the reduced (5%) rate of VAT will apply to supplies of food and non-alcoholic drinks from restaurants, pubs, bars, cafés and similar premises across the UK. Further guidance on the scope of this relief will be published by HMRC in the coming days.

3.3 Temporary VAT cut for accommodation and attractions – From 15 July 2020 to 12 January 2021, the reduced (5%) rate of VAT will apply to supplies of accommodation and admission to attractions across the UK. Further guidance on the scope of this relief will be published by HMRC in the coming days.

4. Young people

4.1 Kickstart Scheme – A 6-month work placements aimed at those aged 16-24 who are on Universal Credit and are deemed to be at risk of long-term unemployment. Funding available for each job will cover 100% of the relevant National Minimum Wage for 25 hours a week, plus the associated employer National Insurance contributions and employer minimum automatic enrolment contributions.

4.2 High quality traineeships for young people – For 16-24 year olds. For the first time ever, the government will fund employers who provide trainees with work experience, at a rate of £1,000 per trainee.

4.3 Payments for employers who hire new apprentices –A new payment of £2,000 to employers in England for each new apprentice they hire aged under 25, and a £1,500 payment for each new apprentice they hire aged 25 and over, from 1st August 2020 to 31st January 2021.

5. Housing

5.1 Temporary Stamp Duty Land Tax (SDLT) cut – The government will temporarily increase the Nil Rate Band of Residential SDLT, in England and Northern Ireland, from £125,000 to £500,000. This will apply from 8 July 2020 until 31 March 2021.

5.2 Green Homes Grant – The government will provide at least £2 for every £1 homeowners and landlords spend to make their homes more energy efficient, up to £5,000 per household. For those on the lowest incomes, the scheme will fully fund energy efficiency measures of up to £10,000 per household. Vouchers will need to be applied.

6. Measure announced earlier

See point 4.2 of the source guidance quoted below for more details:

6.1 Support for Businesses

- Coronavirus Business Interruption Loan Scheme (CBILS)

- Bounce Back Loan Scheme (BBLS)

- Temporarily waiving VAT on Personal Protective Equipment (PPE) from 1 May to 31 October 2020

- Business rates holidays for retail, hospitality and leisure sectors, and for nurseries

- Business grants

- Statutory Sick Pay (SSP) Rebate Scheme

- Safeguarding high streets – The government has implemented measures to safeguard UK high streets by protecting shops and other businesses from aggressive forms of debt recovery and protecting commercial tenants in England, Wales and Northern Ireland from eviction until 30 September. This is accompanied by the government’s publication of a Code of Practice which encourages fair and transparent discussions between landlords and tenants over rental payments during the coronavirus pandemic. The government has also worked closely with lenders to confirm support and flexibility is being shown to commercial borrowers.

6.2 Support for Individuals

- Coronavirus Job Retention Scheme (CJRS)

- Self-Employment Income Support Scheme (SEISS) – The applications for the first SEISS grant are open until 13 July. From 17 August until 19 October, eligible applicants whose businesses have been adversely affected by COVID-19 on or after 14 July will be able to claim a second and final taxable grant worth 70% of their average monthly trading profits, paid in another single instalment covering three months’ worth of profits, capped at £6,570.

- Statutory Sick Pay (SSP) – COVID-19 related SSP has been made payable from the first day of sickness absence, rather than the fourth, and extended to people self-isolating and shielding.

- Mortgage and credit payment holidays includes Buy to Let mortgages

- Support for housing and renters – the government has extended the stay on repossession proceedings in the private and social rented sector until 23 August 2020. Lenders should also pause repossession proceedings until 31 October 2020 to help people to stay in their homes. The government also introduced emergency measures in the Coronavirus Act 2020, which are in place until 30 September, to require landlords to give tenants at least three months’ notice before seeking repossession.

- Income Tax Self-Assessment – The government has supported individuals and the self-employed by deferring Income Tax Self-Assessment payments due in July 2020 to January 2021.

Source: HM Treasury: A Plan for Jobs : documents

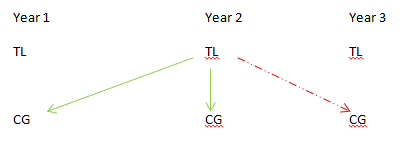

There are three ways in which Trading Losses can be set-off:

There are three ways in which Trading Losses can be set-off: