What is FATCA ?

Foreign Account Tax Compliance Act (FATCA), effective as of 1 July 2014 is a law of United States.

What is the use of FATCA ?

This law is primarily designed to tackle tax evasion by US Citizens and US Companies who keep their savings and investments overseas and do not inform Internal Revenue

Service (Tax department of US Government)

Am I affected?

Yes.

Many countries (like UK) in the world have signed `Inter-governmental agreements` with US Government.

This means all banks operating in the UK have to comply with FATCA provisions.

If you open personal or business bank accounts your bank will ask you to fill in a form. You may wonder why you need to complete this form as you have no connection with the US.

The issue here is, you know that that you have no connection with US but your bank does not know that. You are being asked to complete this form as a confirmation that you have no connection with the US.

Form filling

Most of the forms are straight forward but form W-8BEN-E is a bit complex thus I thought I will write about it.

Part 1 – Identification of Beneficial Owner

1 – Enter name of your company like ABC Limited

2 – Country of incorporation e.g. United Kingdom

3 – Usually left blank

4 – Tick Corporation for a simple limited company.

5 – Most of the legal entities (Companies, partnership, trust etc) in the UK with no connection with US, will be classified as Active Non-Financial Foreign Entity (NFFE) i.e Part XXV.

6 and 7 – as appropriate.

8 – US TIN – Normally you may not have a US Tax Identification number, so leave blank.

9a – Leave blank

9b – HMRC’s UTR number.

10 – Leave blank

Part 2 till Part 24 leave blank

Part 25 – Tick the box

Part 26 till Part 29 leave blank

Part 30 – Sign, name and date in American format (mm/dd/yyyy)

Bonus

I will not repeat what my ex-colleagues at HSBC UK have explained very well already. Please visit their website by link given above.

Note – This article is written as a very simplified guidance to FATCA, your circumstances may be different. Please go to IRS website (click here) to get more information.

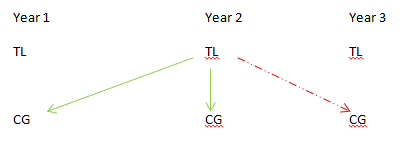

There are three ways in which Trading Losses can be set-off:

There are three ways in which Trading Losses can be set-off: